Sell My House For Free?

Sell your house for free! You absolutely can do it, or should at least become a bit educated about it, and weigh if you can make more money selling your house, don’t you think?

Sell your house for free! You absolutely can do it, or should at least become a bit educated about it, and weigh if you can make more money selling your house, don’t you think?

Since no one ever talks about this, it seems like a big secret. Well, this is the Seattle area and we’re a bit more research and STEM oriented, so I know you can digest these 8 areas. Even if you don’t sell your house for free, you’re sure to pick up some tips to put more money in your pocket with your next home sale.

1. Repair Costs & Staging

A good rule of thumb is to plan on 1-8% of your home’s value for repair and staging costs. To sell your home quickly and for top dollar, you’re going to want to a) spend time, and perhaps funds, cleaning up and putting things into storage, b) paint, clean carpets, take care of obvious repairs, and c) bring in a professional stager. You can try to cut corners here, but that’s a sure way your house is going to be forgettable in this hot seller’s market and not sell for top dollar and take longer too. Alternatively, you can sell as-is (zero cost), and reduce your sales price accordingly. There is a brightside to this, and that is lower tax to be paid on the sale of the house.

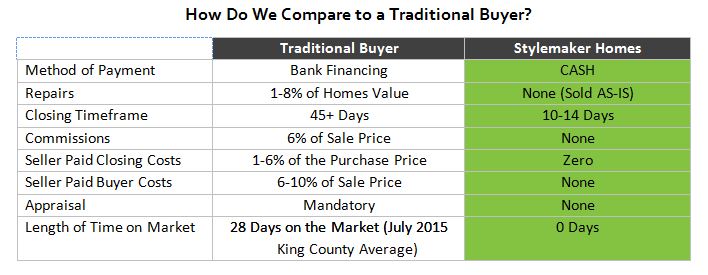

2. Commissions

In America, it’s traditional for the seller to pay a real estate broker a commission to market and sell the property. 6% of the final sale price is typical for getting buyers through the door. The commission is typically split 3% to your agent, and 3% to the buyer’s agent, but you pay it all. Another arrangement might be 3% to the buyer’s agent, and 2% to your agent. Anything less for the buyer’s agent and they tend to overlook your property when compiling lists of homes to show their clients. Redfin is a good option since you pay 1.5% to your agent, or you can even go with forsalebyowner.com, Zillow, or Craigslist and pay a nominal fee or nothing. The trade-off is few buyer prospects. But you can educate yourself on how to sell a home and pay the lowest amount in commissions. If you go the traditional route working with a broker, offer 3% for a buyer’s agent, and do the rest of the work yourself, or contact a real estate investor who will buy your house straight-up, no fees.

3. Time on the Market

The Seattle area is a hot seller’s market. Check out these statistics on single family homes. 28 days was the average for July. That’s stellar. Now imagine it’s day 30 and your home isn’t getting many potential buyers through, and you don’t have any offers. Huge anxiety. Big worries. You were mentally psyched to sell, and now what? Hopefully, you didn’t sign an agreement with a broker for more than a few months. And hopefully not an exclusive one. Because what if you change your mind or want to work with someone else? But anyways, that time on the market is costing you. It’s costing you insurance, mortgage payments, property taxes, utilities, and if you brought in a stager then another month of furniture rental.

4. Traditional Financing vs Cash Buyers

This one always scares me. With an offer that comes with financing, you are no longer selling to the buyer, you are dealing with their bank. The bank can require you to make repairs and the bank will require an appraisal that must come back showing the value of the home. It must come in at or above the sales price. These things can push the closing timeline out, and worse is if the buyer doesn’t qualify for the loan and the deal falls apart. “But wait, the offer came with a pre-qualification letter,” you say. Yes, at a high level review the buyer ‘qualifies’, but it isn’t until there is a mutually accepted contract that the real underwriting begins. It’s when the bank starts digging into the buyer’s details. If your buyer has a low down payment, there is little wiggle room if something comes up. (Fannie and Freddie have 3% downpayment programs again *gulp*). Imagine having to start over with a new buyer and the time ($) that you lose because of the gamble you took accepting an offer that had financing attached to it. Cash is king.

5. Seller Paid Buyer Costs

Typically, buyer’s closing costs are 2-5% of the purchase price. Ok, it’s pretty common for first time home buyers to ask the seller to pay their closing costs. I remember being excited when an offer came in at higher than our asking price. And then I read on. The buyer wanted us to pay their closing costs. Basically, it was their loan costs. Let’s say it was $5,000, but their offer was only a couple grand more. So it was actually less money we’d be making, and a sign that they were tight qualifying for their loan. “Raise your sale price and let the buyer wrap that cost into their financing,” is what your agent will tell you, “you’ll net the same”. Well, you’ll pay a bit more sales tax of course, and the agent will get a slightly higher commission too. Let’s hope the house appraises for the bank at this new higher price. But I say, as a seller, I don’t think I should have to pay for the seller’s costs. If they aren’t prepared to buy, they shouldn’t be shopping!

6. Seller Paid Closing Costs

With a traditional sale, the seller pays their own closing costs. 6-10% of the sale’s price. These are: broker commissions, a loan pay-off fee, title insurance, recording fees, any liens/judgements, prorated property taxes, unpaid HOA to date, utilities, perhaps a termite inspection/repairs or a home warranty premium. You may be surprised to learn that there are buyers out there who will pay most, or even all of these things. It is a seller’s market after all. This is perhaps the biggest area to tackle to be able to sell your house for free. But wait, who are these magical buyers who would pay seller closing costs? Well, we do. Hello there! It’s nice to meet you.

7. Appraisal

We mentioned this above. With a traditional financed buyer, their bank will require an appraisal. It’s mandatory. You can’t get around it. It isn’t that big of a deal if you live in a subdivision and a house or two just like yours sold for about the same price as your contract is for. There is risk if your house doesn’t have good comps. What is bad for an appraisal? Not being able to prove the price in similar style, size, location within .5 miles, sold within 6 months. Your unique 1-story ranch on acreage in an area of two-story new build cookie cutter McMansions is going to be an appraisal problem.

8. Closing Timeframe

This is the time between getting your contract and the close of escrow when you sign and your check is released to you. With a traditionally financed buyer, that means time for an inspection, time then added if any repairs are asked for, time for the appraisal to get done, time for the loan to be formally applied for, underwritten, and the loan documents sent in to the title company/escrow in preparation for the big day. Usually, it’s 45 days. And there are things in standard contracts that allow for the closing date to be automatically pushed out. So the terms in the agreement may say 30 days, but how many days are between when you got it and when you reached acceptance? And again, more time is more money out of your pocket, and after a few weeks, you are ready for the deal to be done so you can stop mowing the lawn and paying utilities.

IN SUMMARY

AND THE NUMBERS – SELL YOUR HOUSE FOR FREE

Assume your neighbor’s house sold for $500,000, but it has a new kitchen, appliances, bathrooms, paint and carpets. Yours does not.

Subtract $70,000 for no remodeling. You’re thinking of listing for $430,000:

Potential list price: $430,000

Repairs (5%) -$21,500

Commission (6%) -$25,800

Holding Costs (45 days) -$2,582

Seller Costs (4%) -$17,200

Buyer Costs (4%) -$17,200

Net funds: $345,718

In conclusion, with this real take home number in mind, contact your local investors first, like Stylemaker Homes, and see what you get offered for not having to do any work, commissions and so forth. You may be surprised.